Company Record Keeping & Audit Requirements

An Essential Guide for Clients

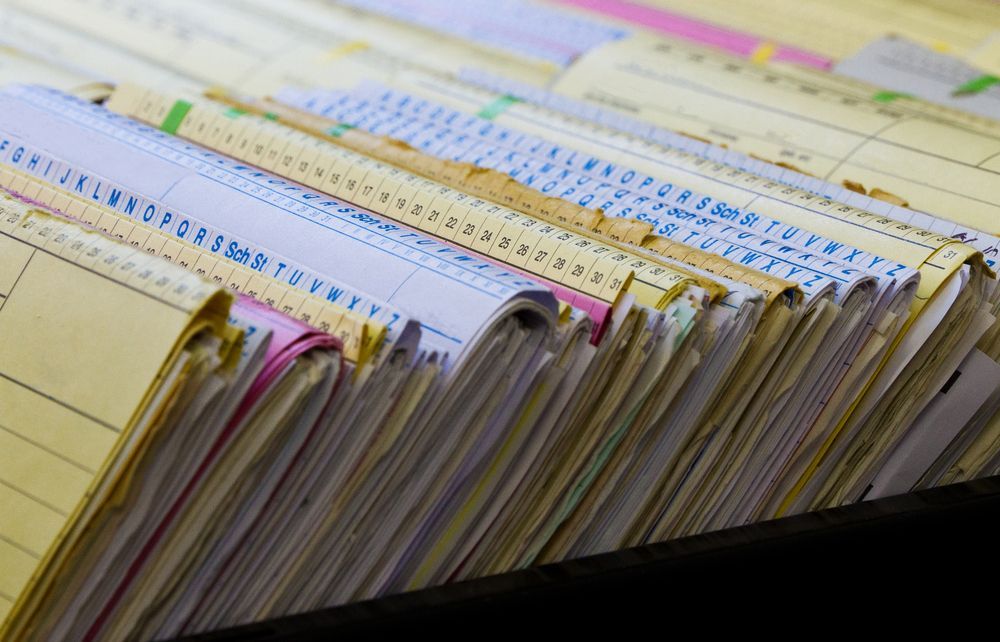

Effective record keeping and understanding audit obligations are crucial for every company. Beyond being a legal requirement, robust systems for documenting and retaining records are fundamental to compliance, sound financial management and risk reduction.

Why is Record Keeping Important?

- Legal compliance: The Corporations Act 2001, tax laws and Fair Work Act mandate specific records and retention periods.

- Financial clarity: Accurate records allow businesses to track performance, manage cash flow and prepare reliable financial statements.

- Audit readiness: Good record keeping ensures you can provide documentation if audited by regulators or during internal/independent audits.

- Dispute protection: Documentary evidence is crucial for resolving legal, tax or employee disputes.

What Types of Records Must a Company Keep?

Companies must retain a broad range of records. The specific requirements depend on your company's structure, activities and employee count, but generally you need to keep:

Financial Records:

- Invoices, receipts and cheques

- General and subsidiary ledgers, journals

- Bank statements, loan agreements

- Profit and loss statements, balance sheets, depreciation schedules

- Tax returns and BAS statements

- Asset and share registers

- Documentation of inter-company transactions

Legal Records:

- Incorporation and registration documents

- Contracts with staff, suppliers and clients

- Lease and insurance agreements

- Copies of the company constitution and minutes of meetings

Employee Records:

- Payroll and PAYG withholding documentation

- Superannuation details

- Staff rosters and timesheets

- Employment contracts and performance records

Other Essential Records:

- Policy and procedure manuals

- Records of complaints, disputes and resolutions

- Marketing campaign documentation

- All correspondence (emails, letters) relating to company business

How Long Must Records Be Kept?

- Statutory minimum: Most company records must be kept for at least 7 years (for company and employee records), though some business and tax records must be retained for 5 years or longer.

- Records must be stored securely—either physically or electronically—and be accessible for inspection or to produce hard copies if requested by authorities.

What Are the Audit Requirements?

Who Must Be Audited?

Not all companies are required to have annual audits. Generally, requirements are as follows:

- Large proprietary companies: Must prepare and have their financial statements audited. A proprietary company is "large" if it meets at least two of the following: $50million+ in revenue, $25million+ in assets or 100+ employees.

- Public companies and disclosing entities: Must have full audits and lodge financial reports with ASIC annually.

- Small proprietary companies: Generally exempt unless directed by ASIC, shareholders or subject to foreign control/funding requirements.

- Charities and not for profits: Medium to large organisations (by revenue) face audit or review obligations under ACNC rules.

- Specific industries or grants: Some regulated industries or government grants require audited financials regardless of company size.

Audit Process & Obligations

- Record provision: Directors are responsible for ensuring auditors have timely access to all requested records, even if held by an external accountant or third party.

- Regular internal checks: Conducting internal audits and maintaining robust backup procedures are best practice for compliance and early error or fraud detection.

- Qualified auditors: Only auditors qualified and registered with ASIC or a professional accounting body can perform statutory audits.

Best Practices for Clients

- Embrace digital systems: Cloud based accounting and payroll software can simplify compliance and improve security.

- Back up data: Regularly back up both physical and electronic records.

- Assign responsibility: Appoint a compliance officer or accountant to oversee adherence to record keeping and audit requirements.

- Train staff: Ensure employees understand what must be documented and for how long records should be retained.

- Periodic review: Schedule regular checks to verify records are complete, up to date and readily accessible.

Staying compliant with record keeping and audit requirements reduces regulatory risk, strengthens your company’s governance and ensures readiness for opportunities and challenges alike. Consult your accountant or legal adviser for guidance tailored to your business’s unique obligations.